When the check comes, the math begins. Many diners wonder:

“Should I tip on the total before or after tax?”

It’s a reasonable question—after all, no one wants to shortchange a worker who depends on tips. But this seemingly small dilemma exposes a much bigger problem: Why are we calculating someone’s income based on whether or not we bought an extra soda or paid local taxes?

Let’s break down what the current advice says, and why the entire system needs rethinking.

The Common Answer: Tip on the Pre-Tax Total

Most etiquette experts, restaurant industry guides, and even tipping calculators agree:

Tip on the pre-tax subtotal.

That’s the cost of your food and drinks before state or local taxes are applied.

Why?

Taxes aren’t part of the service the staff provided. The amount varies by location, and tipping should reflect the cost of the meal, not the cost of government policies. It’s cleaner for mental math (e.g. 20% of $50 is easier than 20% of $53.88).

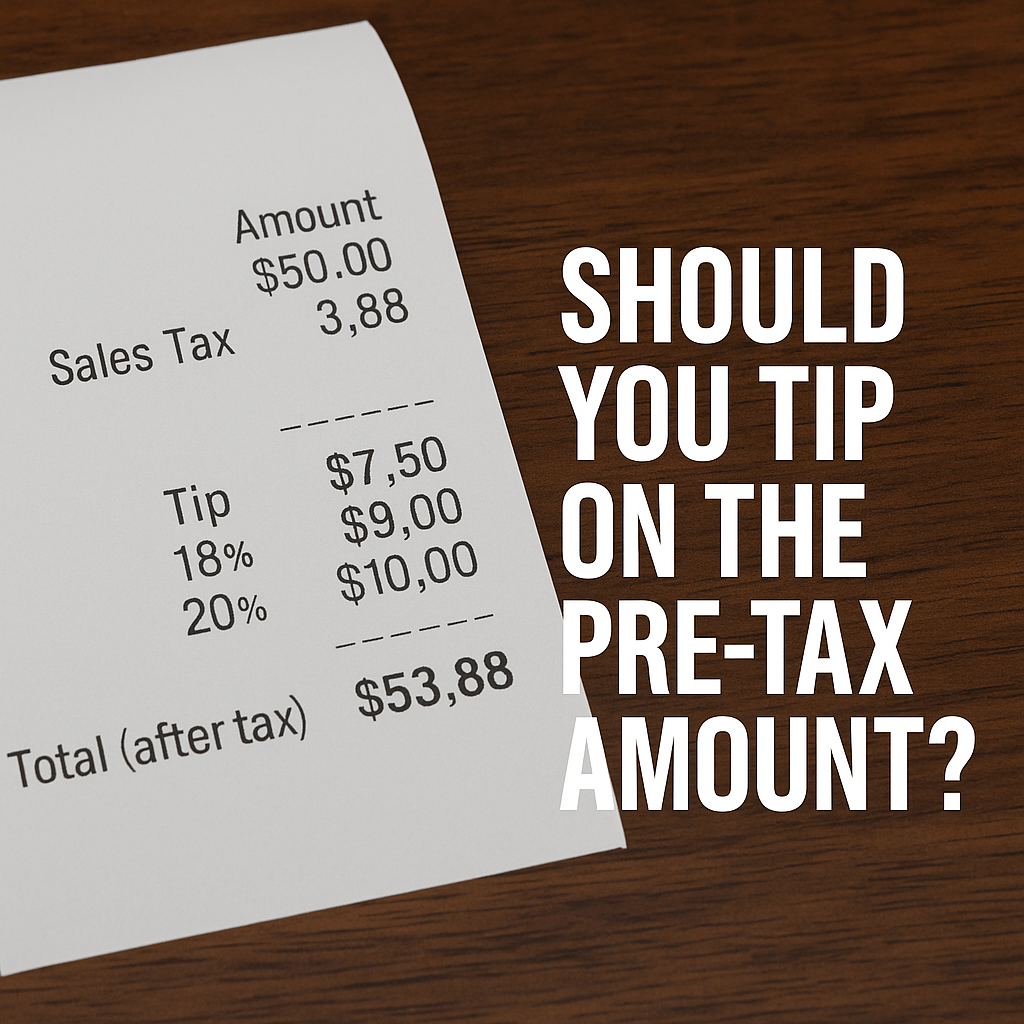

So if your total bill is $53.88, with $3.88 in tax, a 20% tip would be calculated on the $50 subtotal—equaling $10.

But Customers Are Confused—For Good Reason

Here’s the irony: Most people aren’t told clearly what to tip on. And many tipping screens (at cafes, restaurants, and salons) calculate tips based on the post-tax amount, often without disclosing it.

So even if you want to tip fairly but avoid overpaying, the system nudges you toward tipping more than intended. Why? Because many point-of-sale systems and service industry norms are designed to maximize tips, not clarify etiquette.

This creates frustration and uncertainty—and again, puts the burden on the customer to figure it out.

The Bigger Issue: Why Are We Even Debating This?

This debate over tipping before or after tax highlights a deeper flaw:

Why should a worker’s income be determined by random customer calculations? Why does a waiter in a high-tax state potentially get tipped more for the same service than one in a low-tax state? Why is the default wage for many service workers below $3 an hour, forcing them to rely on tips to begin with?

When employers underpay workers and expect tips to fill the gap, it creates a system where even taxes become a tipping point.

What You Can Do

If you’re navigating tipping in the current system, here are a few fair ways to approach it:

Tip on Pre-Tax (with clarity)

If you’re doing the math yourself, calculating your tip on the pre-tax subtotal is widely accepted and reasonable.

Look for built-in tip calculations

If your receipt or app gives tip suggestions, check whether they’re based on the post-tax total. Adjust accordingly if you want.

Speak up for better pay

Support restaurants, cafes, and salons that pay fair wages or follow no-tipping models. The best way to remove confusion is to remove the need for tipping altogether.

Final Thought: It Shouldn’t Be This Complicated

Whether you tip on $50 or $53.88 shouldn’t make or break someone’s paycheck.

Tipping should be a thank you, not a salary.

If we want a fairer system, we need to stop debating the decimals and start demanding that employers pay their workers a living wage.

Join the movement to end tipping culture and support wage reform at endtippingculture.org

Leave a comment